The Internet of Things (IoT), major technological advances, and shifts in a number of aspects of the work environment are all expected to have a material impact on the shape of the Workers’ Compensation industry in the future. These dynamics served as the back drop for NCCI’s recent Annual Issues Symposium (AIS) “The Future@Work” held in Orlando, FL. The focus on connecting Work, Worker, and Workplace served as the central theme for the annual meeting of the Workers’ Compensation industry executives, underwriters, brokers, and reinsurers.

Conference Overview

Bill Donnell, NCCI’s President and CEO, opened the conference with a quick look back on the 30 years of the organization’s Annual Issues Symposium and how the session has evolved into one of the most important gatherings of WC industry professionals. The individual sessions focused on current issues, recent trends, and potential future developments impacting the industry, including:

- Industry results;

- How trends in medical and indemnity costs impact WC claims of all sizes;

- Marijuana and Prescription Drug / Opioid use;

- Addressing the increasing cost burden through Provider Networks;

- WC from a Risk Managers’ view;

- Update on Blockchain and B3i initiatives.

State of the Line Report

Mr. Donnell’s industry overview set the backdrop for the highly anticipated State of Line Report. Presented by NCCI’s Chief Actuary, Kathy Antonello, the update provided a summary of the  recent results and relation to the broader P&C industry. In a detailed review of the figures, Ms. Antonello discussed the line’s financial results and trends.

recent results and relation to the broader P&C industry. In a detailed review of the figures, Ms. Antonello discussed the line’s financial results and trends.

In general, the voluntary market continues to remain competitive though responsible. Workers’ Compensation 2017 premium volume was flat at approximately $40Bn, or just over 7% of the U.S. P&C industry. This exists despite a booming economy, increased wages / payrolls, and full employment. Factors offsetting these positive influences are:

- Increases in offshore cessions and ceded premiums due to a competitive reinsurance market;

- Decreases in loss costs;

- Little change in primary insurance company rates;

- Favorable frequency trends;

- Healthy Assigned Risk/Residual Market.

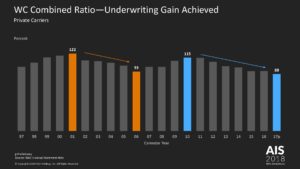

The industry is strong. Favorable recent results allowed the industry to post under a 90% combined ratio for 2017 – the best result since the 1950s. This result is impressive and represents the 4th consecutive year that the line has made an underwriting gain; supported by an underlying loss ratio of 49% – a historic low. Headwinds exist in the form of increases in indemnity and medical severity, as well as marginal investment income gains.

The industry is strong. Favorable recent results allowed the industry to post under a 90% combined ratio for 2017 – the best result since the 1950s. This result is impressive and represents the 4th consecutive year that the line has made an underwriting gain; supported by an underlying loss ratio of 49% – a historic low. Headwinds exist in the form of increases in indemnity and medical severity, as well as marginal investment income gains.

Read the full report here